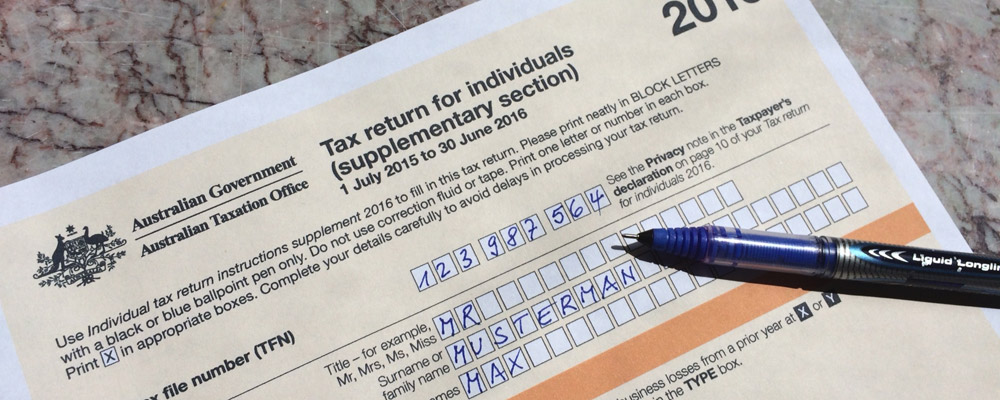

Step-by-Step Guide for Completing Your Tax Refund in Australia

Step-by-Step Guide for Completing Your Tax Refund in Australia

Blog Article

Checking Out the Benefits of Filing an Income Tax Return: Maximize Your Tax Obligation Reimbursement This Year

Submitting a Tax return is often regarded as a challenging job, yet it plays a crucial function in enhancing your financial standing. By methodically reporting earnings and leveraging offered reductions and debts, people can tap right into the capacity for significant tax obligation reimbursements.

Value of Declaring a Tax Return

Filing a Tax return is a considerable duty for organizations and people alike, as it serves both compliance and financial monitoring purposes. Complying with tax legislations is crucial, as stopping working to submit can lead to significant penalties, interest fees, and possible lawful consequences. By sending an income tax return, companies and individuals show their commitment to satisfying their public tasks and add to the performance of civil services.

Moreover, filing a Tax return provides a chance for taxpayers to evaluate their financial circumstance. It allows them to track income, expenditures, and total economic health, which can educate future budgeting and financial investment choices. For numerous, tax returns are a portal to potential reimbursements, as overpayment of tax obligations throughout the year can be reclaimed, offering a much-needed economic boost.

Additionally, the income tax return process can help with access to different economic services and products. Lenders usually require income tax return when determining credit reliability for home mortgages or finances, making it important for people and services looking for monetary assistance. In verdict, submitting an income tax return is not merely a regulative responsibility; it is a significant action in preserving economic stability and revealing prospective advantages.

Understanding Tax Reductions

Tax reductions are frequently forgotten yet play a crucial function in lowering gross income and making best use of prospective reimbursements. Comprehending the various kinds of tax obligation deductions available can considerably impact your overall tax responsibility. Reductions can be categorized right into 2 major kinds: basic reductions and itemized reductions.

The standard deduction is a fixed dollar amount that taxpayers can deduct from their earnings, varying based on declaring condition. For numerous individuals, especially those without considerable itemizable expenses, taking the common reduction is useful. On the other hand, itemized deductions enable taxpayers to checklist eligible expenses, such as home loan rate of interest, clinical expenses, and philanthropic payments, potentially generating a higher reduction than the basic alternative.

It's vital to keep careful documents of all insurance deductible expenditures throughout the year to ensure you catch every eligible deduction. Additionally, details deductions may be subject to phase-outs or constraints based on revenue levels. Familiarizing yourself with these subtleties can assist you strategically intend your funds and maximize your income tax return. By leveraging and understanding tax obligation deductions effectively, taxpayers can decrease their taxed income and enhance their general tax obligation refund.

Checking Out Tax Obligation Credit Scores

Maximizing your tax savings involves understanding the various kinds of tax credit histories offered to you. Tax obligation credit reports straight decrease your tax liability buck for buck, making them extra useful than deductions, which just lower your taxable revenue.

There are two primary categories of tax credit ratings: nonrefundable and refundable. If the credit surpasses your tax owed, nonrefundable credit scores can decrease your tax obligation liability to no but will certainly not result in a refund. Refundable credit histories, on the various other hand, can produce a reimbursement also if you have no tax obligation obligation, making them specifically advantageous for lower-income taxpayers.

Usual tax credit scores consist of the Earned Revenue Tax Credit History (EITC), which supports low to moderate-income functioning people and households, and the Kid Tax Credit rating, which supplies financial relief for taxpayers with dependent kids. Education-related credit scores, such as the American Chance Credit History and the Life Time Discovering Credit score, aid counter the expenses of college.

Common Mistakes to Prevent

Navigating the intricacies of income tax return can lead to numerous common challenges that taxpayers ought to be aware of. One significant blunder is stopping working to report all income sources. Also small srtp tax amounts from side tasks or freelance job need to be included, as the IRS obtains duplicates of all earnings declarations.

An additional regular mistake includes forgeting deductions or credit ratings for which one is qualified. Taxpayers should extensively investigate potential reductions, such as for pupil finances or medical costs, to avoid leaving cash on the table.

In addition, errors in individual information, such as Social Safety numbers or declaring condition, can postpone handling and refunds. It is vital to ascertain all information prior to submission to guarantee accuracy.

Filing late or neglecting to submit completely can additionally cause penalties and missed out on chances for reimbursements. Taxpayers must recognize target dates and plan accordingly.

Last but not least, many people forget to maintain detailed documents of expenses and supporting papers. Organized documentation is basic for substantiating claims and facilitating any future audits. By avoiding these usual mistakes, taxpayers can enhance their filing process and improve their potential reimbursements.

Tips for Optimizing Your Refund

Following, think about adding to pension, such as an IRA. Payments made prior to the tax obligation due date can be deducted, potentially increasing your reimbursement. Additionally, if you are independent, make certain to represent business-related expenses that can minimize your gross income.

An additional important method is to file your return online. E-filing not only accelerates the processing time yet additionally reduces errors that can take place with paper entries. Verify that you choose the right filing standing; this can greatly affect your tax obligation price and qualification for specific credit scores.

Last but not least, maintain meticulous documents throughout the year. Organizing invoices and financial records can streamline the filing procedure and assist you determine potential deductions that you may or else miss out on. By taking these actions, you place yourself to obtain the optimum refund feasible.

Conclusion

By systematically reporting revenue and leveraging offered deductions and credit histories, people can touch into the capacity for significant tax reimbursements. For several, tax obligation returns are a portal to potential refunds, as overpayment of taxes throughout the year can be reclaimed, providing a much-needed financial boost.

Comprehending the different kinds of tax deductions offered can substantially impact your total tax obligation obligation. Online tax return Australia. By leveraging and comprehending tax obligation reductions properly, taxpayers can decrease their taxed revenue and improve their general tax reimbursement

Report this page